Setup Managers

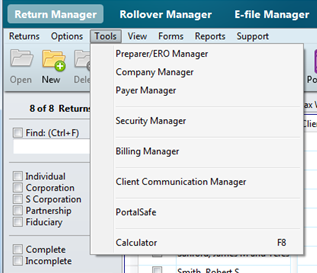

The following managers are generally used to help you set up information to be loaded into multiple returns. These managers are available under the Tools menu.

Setup Managers (under Tools menu)

Preparer/ERO Manager

Use the Preparer/ERO Manager to establish a list of paid preparers in your firm, along with the information that must be included in any tax return’s Paid Preparer section.

Company Manager

The Company Manager retains core information for companies, such as EIN, address, and state ID. This database makes preparing multiple returns for the same company faster and more accurate. By default, companies are automatically added to this repository when they are entered directly into returns.

Payer Manager

The Payer Manager is the database that retains core information for payers. By default, payers are automatically added to this repository when they are entered on Input Worksheets and Detail Schedules.

Security Manager

The Security Manager enables the Admin user to set up users and passwords and to grant and/or restrict rights to specific features within ATX.

Billing Manager

The Billing Manager allows you to set up rates for specific tax forms and schedules, flat rates by return type or preparer and/or hourly billing rates by preparer. Rates entered appear on the billing invoice, which can be attached to returns like any other form.

Client Communication Manager

The Client Communication Manager houses the Custom Client Letter functionality.

See Also: